Unlike his Republican counterparts Obama represents social inclusion, a fact borne out by the multi-ethnic constituency the democratic party sewed together, and which looks set to strengthen as the demographic balance in the US swings inexorably away from the white majority.

Yet the election did not do much to change the domestic balance of power. Republicans retain control of the lower house; democrats retain their small majority in the senate. The only hope that Washington’s gridlock politics will unravel is that the Republican Party undergoes an epiphany. To take back the White House they will have to remove the Mad Hatter from its ‘tea party’; tame religious zealots; broaden their appeal to minority groups; and tack towards the deal-making centre. The chances of all that happening in the next four years currently look pretty slim.

The election did reaffirm the faith of many around the world in the resilience of US democracy, thereby cementing US ‘soft power’. Since the US is still the largest economy in the world by some margin, and by far the largest military power, it will remain the indispensible nation for the foreseeable future even if the degree of its indispensability is diminishing.

But gridlock at home means the status quo abroad will be retained. Therefore, do not expect much leadership from the US in key forums such as climate change negotiations (superstorm Sandy notwithstanding); the World Trade Organization’s Doha round; or the G-20 summit process.

Power is also changing hands in Beijing. By contrast to the US, the process is the product of back-room deals in smoke-filled rooms in undeclared locations. That the legitimacy of the outcome was challenged by no less an inside figure than Bo Xilai, the now disgraced Secretary of the Communist Party’s Chongqing branch, speaks volumes for the underlying tensions in the party and society.

Decades of spectacular growth have raised popular expectations for political reforms – an inevitable consequence when the middle class ascends so rapidly. Yet the economic model that delivered rapid growth has become unsustainable: environmentally; externally through tensions with trading partners; rising domestic costs; and a proliferation of domestic lobbies seeking to hold on to privileges enjoyed under the current model.

So the new leadership, which arguably enjoys the least legitimacy of any communist party government, must now decisively change economic course whilst managing the fallout from a growth slowdown. Thus political risk has blipped onto the radar in China, at the same time as economic risks are rising. This combination is a recipe for domestic gridlock, and consequent continuation of hesitant Chinese leadership on the global stage.

Meanwhile Europe’s slow motion currency crisis continues to bubble under. Whilst the Euro is no longer under immediate threat of breaking up – thanks to strong intervention by the European Central Bank – the underlying institutional and political challenges have not been resolved. It will take some years to do so, if indeed there is a decisive resolution. Meanwhile the UK and other northern liberal countries, notably Finland, continue to explore how best to extricate themselves from some European entanglements. Therefore gridlock or at best slow motion institutional evolution is likely to be the order of the day in Europe.

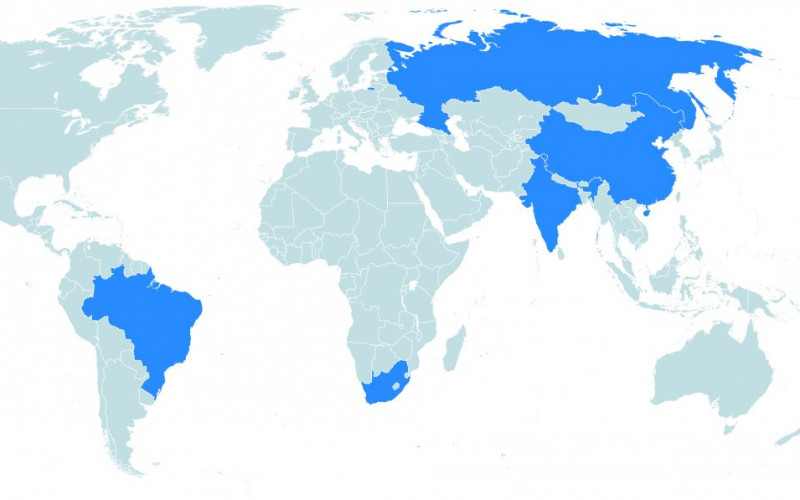

Add all this together and we have the makings of what some scholars have dubbed a ‘G0 world’ for the foreseeable future. Unless key leaders in the three poles of global economic leadership surprise us all, take risks, and do the ‘right thing’, the world will have to muddle along.

What should South Africans make of this?

First, our preparations for key international negotiations need to be calibrated accordingly. Unfortunately the only forum that retains some vitality and decision-making potential is the G-20. Major multilateral negotiations involving close to 200 countries provide more legitimacy, but less effectiveness. Consequently the G20 should receive priority in national economic diplomacy, and alliances that serve national interests in this forum should be harnessed accordingly.

This requires taking a more pragmatic, issues-based approach to our engagements. Anti-western posturing has its uses, but in a world of continued US leadership and Chinese reticence, it also has limitations.

Second, economic diplomacy abroad is rooted in domestic political economy. One of the sharpest issues in the US elections was an unresolved debate over the relative balance to be accorded to state direction of the economy and society versus markets, against the backdrop of a growing fiscal crisis.

Similarly, the European sovereign debt crisis exposes a historic rolling back of previous state intervention in society through the establishment of elaborate welfare states that saddled future generations with the bill. Moreover, if China is to take its economic development to the next level a new round of market reforms is required in order to promote innovation and industrial upgrading through the dynamic part of the economy – the private sector. Unlike Europe though, China is still in the process of constructing its social safety net.

These challenges are echoed in SA’s domestic conundrums. Has the state assumed too large a role in our economy, relative to the means represented by a small tax base? How far can social welfare systems be extended? Is the private sector really on an ‘investment strike’, or simply reticent to invest in the face of mixed messages and occasionally hostile interventions coming from government?

We need clear leadership to resolve these issues and establish a strong, growth promoting investment environment. Unfortunately the Zuma coalition, or any other conceivable coalition that may replace it at Mangaung, suffer from strong centripetal forces. So the ANC is very unlikely to deliver decisive, growth-promoting leadership. Hence SA, like the global economy, is likely to muddle along as our social crisis gathers steam.

At least we are not alone. Muddling has become the new normal – until the next major global or local crisis.