Although foreign direct investment (FDI) flows in all of the countries have increased, intra-BRICS flows do not correlate with trade figures. Overall, there is less clarity on specific detail of FDI flows among the five countries, and on how they can be encouraged. With respect to outward FDI, there seems to be little strategic policy direction. The policy briefing outlines the existing outward investment motivations and destinations for each of the countries, and the historical sources of FDI for the BRICS. It provides a series of policy recommendations, which are aimed at enhancing FDI flows among the BRICS.

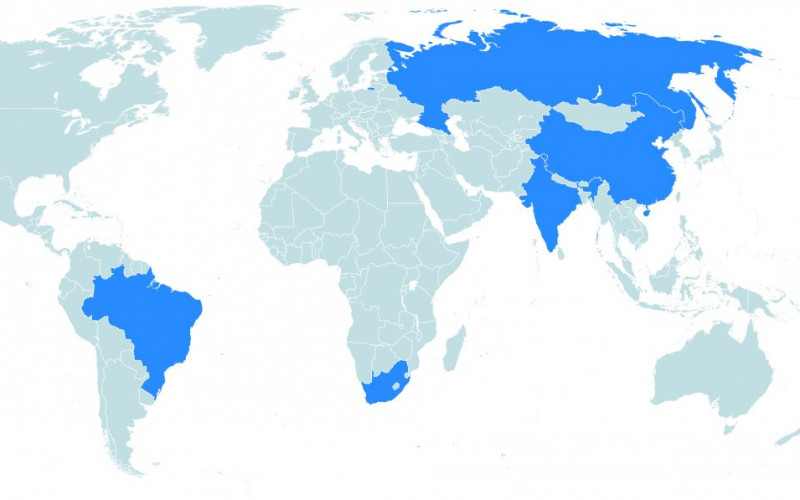

BRICS Investment

With the fifth BRICS Summit upon us (26–27 March 2013), the shift in global economic power to the BRICS is clear. Intra-BRICS trade has been growing well. According to Standard Bank estimates it reached $310 billion in 2012. In contrast, the BRICS investment story has not been as positive, though theoretically, the BRICS (as emerging economies) have comparative advantage investing in each other over their Northern counterparts. Dunning ascribes foreign direct investment to ownership, location and internalisation (the OLI Model) which significantly shifts bargaining power towards emerging-economy multinational corporations (MNCs), leapfrogging some of the expected steps in foreign entry mode – exports, minority joint ventures, majority joint ventures, and mergers and acquisitions (M&As). Sun et al. propose that emerging-economy MNCs are mostly motivated by industrial factor endowments, dynamic learning, value creation, strategic assets, and institutional facilitation.